Pvilion Blog | October 23, 2023 | By Julia Fowler

What is the Investment Tax Credit?

The Investment Tax Credit (ITC) originated from the Energy Policy Act of 2005. Although it was originally set to end in 2007, its success in promoting the shift to renewable energy in the United States led to many extensions over the past several years.

Most recently, the Inflation Reduction Act was signed by President Biden in August of 2022, extending the ITC for the next ten years. This means that businesses can continue to benefit from a 30 percent tax credit until 2032. The tax credit will remain available at 26 percent in 2033 and 22 percent in 2034.

To learn more about the ITC, click here.

How Does this Benefit Tax-Exempt Entities?

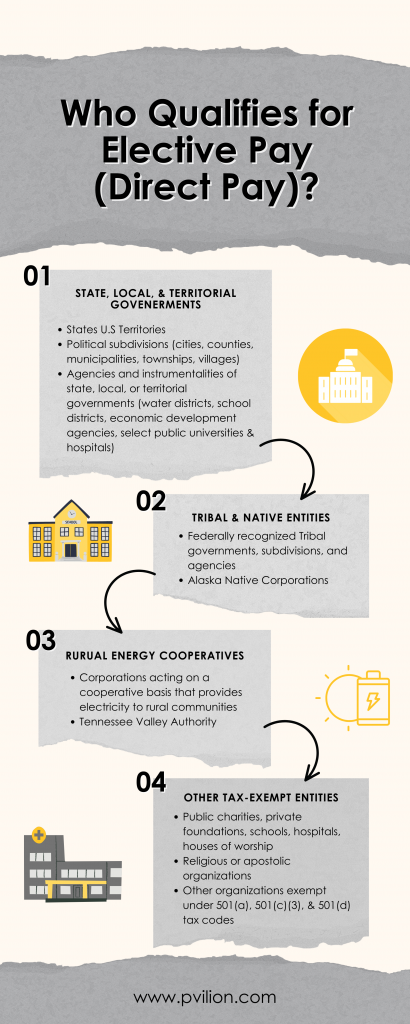

Elective pay, also referred to as direct pay, is a provision of the Inflation Reduction Act that allows tax-exempt entities to join the private sector in benefitting from the incentive program. It essentially makes qualifying clean energy tax credits refundable. Qualifying entities can now receive payment from the IRS of equal value to the ITC for any qualifying clean energy project.

How Does it Work?

So, for example, if the ‘City of Solarsville’ purchased Pvilion Solar Canopies for each of their parks, the city could apply to receive up to 30% or $40,000 (whichever is lower) of the entire solar canopy system back through elective pay. That would be 30% of the entire project’s cost, including the structure, battery storage systems, installation labor and permitting, hardware and equipment, and applicable sales tax. That money could then be used by the city for any other projects or programs.

How Can You Apply for Elective Pay?

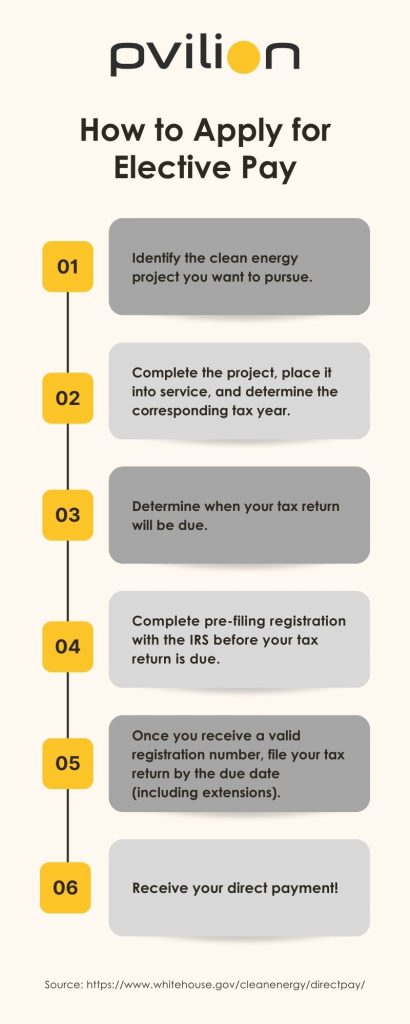

According to whitehouse.gov, the steps for applying for elective pay are as follows:

This is the first time that tax-exempt entities have had the opportunity to use this type of tax incentive. This will help nonprofits, government agencies, and many more to save money on clean energy and allow them to allocate more funds towards their mission.

Other Resources

The IRS website has a lot of information for commonly asked questions regarding the ITC and elective pay: https://www.irs.gov/credits-deductions/elective-pay-and-transferability.

Full list of applicable tax credits for elective pay: https://www.irs.gov/pub/irs-pdf/p5817g.pdf.

The white house also released a helpful video brief explaining elective pay. Video:

More about the ITC:

Want to learn more about how Pvilion Solar Canopies can transform your outdoor space? Get in touch with our solar fabric experts to learn more and receive a free quote.

Disclaimer: This post was prepared for informational purposes only and is not intended to be used as financial or tax advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

news + press

news + press